In December 2022, Louisville Metro Council awarded $13 million to the Louisville Affordable Housing Trust Fund (LAHTF) to combat the injustices of families who experienced redlining. Redlining in real estate, is a discriminatory practice of denying or offering less favorable loans for housing to people in certain neighborhoods or areas based on their demographics or perceived risk. The term comes from the 1930s when lenders would draw red lines on maps to mark the areas they would avoid. This intentional practice contributed to the racial segregation and inequality that shaped the way America looks today.

LAHTF’s Redlining Mitigation program will be known as REVERT, an acronym for Restoring Each Viable Economically Redlined Territory. REVERT strives to provide homeownership opportunities for families disproportionately impacted by redlining in previously redlined neighborhoods. Many of these neighborhoods overlap Covid-19 effected areas. Through funding and resources, we plan to prioritize these efforts on undervalued, abandoned, and vacant properties.

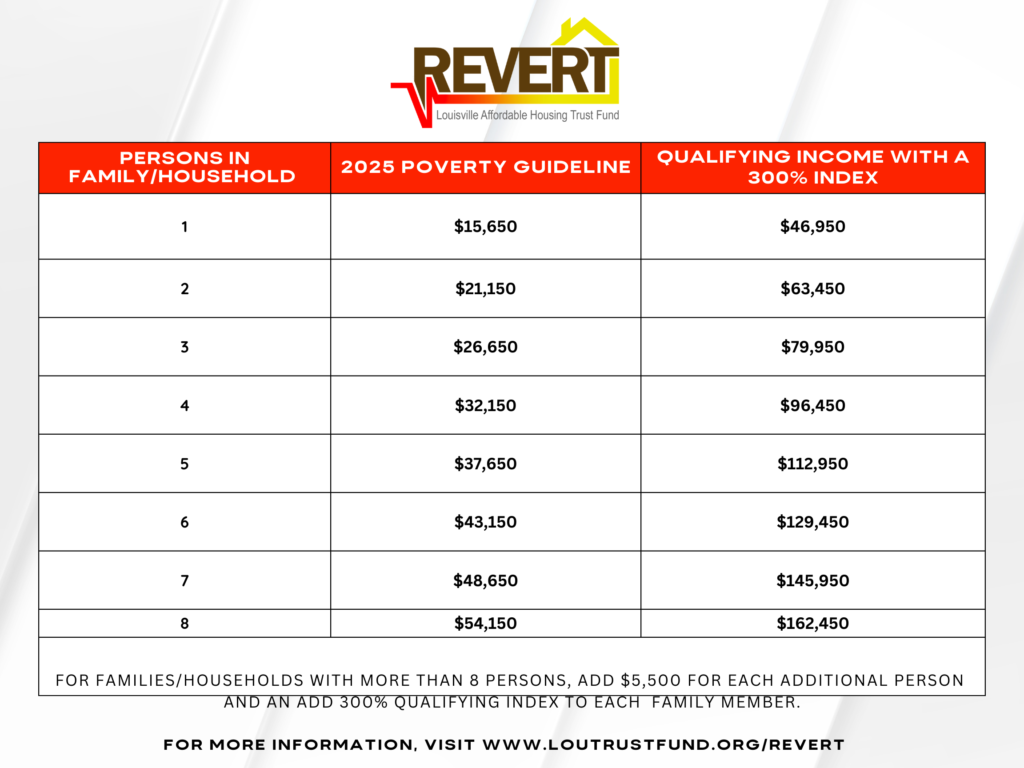

The REVERT program will provide 216 families up to $50,000 in rehabilitation funding towards a home purchase. The funds can be used towards updating a property for code compliance, enhancing energy efficiency, updating decor and interior designs, as well as enhance the curb appeal of a property. Sometimes funds may be used to demolish a structure, clear the lot, and build a new structure on the site. All construction MUST adhere to REVERT guidelines of required repairs. The funds are forgivable as long as the applicant is an owner occupant for at least 15 years. The selected property should be in a previously-redlined area. Steps will be taken to validate that an applicant has family lineage tied to a previously redlined area.

Redlining in Louisville

Redlining dates back to 1933, when the U.S. government created the Home Owner’s Loan Corporation (HOLC) to bolster the housing market and homeownership opportunities across the nation. The HOLC created residential securities maps, better known as redlining maps, to guide investment in U.S. cities. These maps assigned grades to neighborhoods to indicate their desirability for investment. Black, immigrant and low-income neighborhoods were often given low grades, eliminating their access to mortgage insurance or credit for decades. Although the HOLC was discontinued in 1951, the impact of disinvestment resulting from redlining is still evident in Louisville and most other U.S. cities today.