Housing Programs

3 Steps to Funding Your Project with LAHTF

(1) READ the Program Guidelines then send in the pre-application.

(2) Upon approval to move forward, submit the full application with all supporting documents.

(3) Forward the appropriate application fee within 5 days of application submission.

In June 2023, Louisville Metro Government allocated $15 million in funds for the LAHTF for FY’2024. The funds will be used as follows:

- $14 Million for development activities, rehab/reuse of vacant/abandoned properties, and mixed income projects integrating low income housing, of which:

- At least $5 million for units reserved for households with incomes up to and equal to 30% AMI;

- At least an additional $2.5 million for units reserved for households with incomes up to and equal to 50% AMI;

- Balance may be used for households up to and equal to 80% AMI.

- At least $7.5 million will be used for the Trust Fund’s Revolving Loan fund.

- Full or partial repayment may be required (based on population served and underwriting); and,

- Range of 0% to 3% interest rate.

- $1,000,000 for program administration, of which $100,000 will be used to create a grant pool for Supportive Housing Services.

To effectively address Louisville’s housing needs, the LAHTF requires a dedicated source of ongoing public revenue, key to success of all housing trust funds. In 2008, the Louisville Metro Council established by ordinance a goal of identifying $10 million in dedicated, annual public revenue for the LAHTF. The source of this commitment has not yet been identified.

Establishing dedicated ongoing public revenue, which gives the LAHTF both stability and flexibility, remains a top priority for the organization.

Additionally, more than $971,792 million remains from the 2021 Adopt-A-Block homeownership projects located in areas with a high concentration of vacant and abandoned structures or lots. The goal of this program is to address vacant/abandoned properties through the creation of direct purchase or lease-purchase opportunities. The program shall concentrate on areas included in the Tax Diversion District (TDD) ordinance. All projects must be located in an area of high concentration of vacant and abandoned structures or lots. Purchasers of homes shall commit to living in them for periods of up to fifteen (15) years and shall agree that if the homeowner leaves prior to the end of that period, proceeds will be repaid to LAHTF or the property must be sold to another home buyer meeting the program’s income limitations. Additionally, LAHTF’s application scoring shall include preferences for contractors who offer new employment, training, and sub-contracting opportunities to low- and very low-income residents of the areas where the projects are located and businesses that substantially employ these persons.

The LAHTF and Louisville CARES has created an online Pre-application Portal is a prerequisite to apply for funding through either the LAHTF or Louisville CARES. The pre-application is designed to obtain necessary information to direct applicants to the most appropriate funding source. Use this link, https://louisvilleky.wufoo.com/forms/ppahc570216sbm/, to complete the pre-application for funding.

Download the 2024 Application Guidelines

Housing Development

Eligible uses for development funds include:

Eligible uses of funds include:

- Land/site;

- Sustaining/preserving affordable housing;

- Construction loan financing;

- Gap funding or reasonable developer subsidy (which may include forgivable loans); and,

- Low cost, permanent financing (terms and interest rates based on pro forma review to determine the ability to repay).

Funds may only be used on eligible affordable housing projects located in Louisville-Jefferson County. If funded, projects will be governed by the cumulative information contained in these guidelines, as well as any applicable federal, state, and local requirements.

Recipients of funds will be expected to be familiar with and adhere to the guidelines and project design requirements described in this document and other applicable LAHTF documents.

Download the 2024 Housing Development Funding Application | Spec Sheet Template | Internal Cost Cert Template | Sources and Uses | Homebuyer Affordability Analysis Worksheet

Supportive Housing

The Louisville Affordable Housing Trust Fund has allocated Funding Dollars to assist those programs or services that do not fit the Trust Fund definition of a Development Project. By definition, Supportive Housing Services (SHS) are a combination of housing and services intended as a cost-effective way to help people live more stable, productive lives.

Services may include, but are not limited to programs that:

- Provide HUD approved housing counseling and education services;

- Provide employment and workforce housing skills;

- Increase household financial stability; and

- Other Programs as submitted and deemed to align with ensuring the success of a housing project development plan focused on serving Low to Moderate Income Individuals as that term is defined by US

- Mental Health Counseling

For more information, see the Project/Program Guidelines.

*Funds may only be used on eligible affordable housing programs located in Louisville-Jefferson County. If funded, projects will be governed by the cumulative information contained in these guidelines, as well as any applicable federal, state, and local requirements.

Download the 2024 Supportive Housing Services Grant Application

Stockyards' Home Owners' Assistance Program

Stock Yards Bank & Trust has partnered with the Louisville Affordable Housing Trust Fund to help homeowners pay for needed repairs and replacements at home. The new Stock Yards Bank Home Improvement Grant offers forgivable mortgages to those with low-moderate income to make home repairs including, replacing HVAC systems, doors, windows, roofing, siding or gutters in addition to other energy efficiency upgrades, accessibility improvements and safety repairs.

The Stock Yards Bank Home Improvement Grant program was announced today at the Louisville Affordable Housing Trust Fund office. In attendance were Stock Yards Bank leadership and partners at the Louisville Affordable Housing Trust Fund.

“Our community benefits when all people have a safe place to live and call home,” said Stock Yards Bank chairman and CEO James A. (Ja) Hillebrand. “Stock Yards Bank wants to help improve the safety and livelihood of our fellow Louisvillians by funding improvements that may have otherwise been out of reach.”

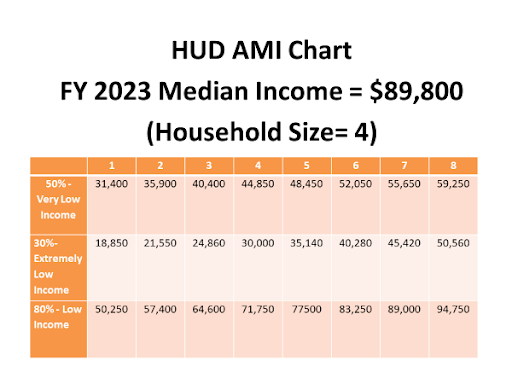

Louisville Affordable Housing Trust Fund will screen applicants and Stock Yards Bank and Trust will review the applications. To find out if you are eligible for one of the loans of up to $6000, visit https://loutrustfund.org/ or call 502-637-5372. A pool of $70,000 is available. Some limitations apply for eligible uses of the loans. Borrowers’ income must be certified and deemed eligible under HUD income AMI limits 80% or below or, borrowers must reside in an LMI census tract. Beneficiaries must be the owner occupants. Loans will be forgiven over a three-year period.

Stock Yards Bank empowers its team members to make meaningful impacts in the communities they serve. Stock Yards Bank Assistant Director of Operations Aprel Doherty is proud to serve on the board of the Louisville Affordable Housing Trust Fund as a voice for the banking community. Her work helps open the door to opportunity in Louisville communities through affordable housing solutions like the Stock Yards Bank Home Improvement Grant program.

“It’s important for community banks to be good neighbors and, leaders” said Stock Yards Bank Director of Community Engagement and Outreach Laurent Houekpon. “Stock Yards Bank is working to demonstrate how companies can improve housing stability, make a difference and build safer neighborhoods through a range of community programs and partnership.”

Who is eligible?

- Borrowers’ income must be certified and deemed eligible under the HUD LMI income limits for 2022, or borrower must reside in an LMI census tract.

- Loan amount will be up to $6,000

- Eligible uses are as follows:

- HVAC mechanical repair/replacement.

- Windows and Door replacement.

- Roofing

- Energy Efficiency upgrades such as insulation, etc.

- Accessibility improvements such as ramps, bathroom repair, etc.

- Safety or soundness repairs such as concrete work, deck repair, etc.

- Exterior improvements such as painting, siding or gutters.

- A mortgage will be required. Loans will be forgiven over a 3 year period

- Stock Yards Bank & Trust will run a credit report and title search only to ensure nothing appears that would jeopardize their position in case of sale, forfeiture, etc.

- LAHTF will contact each borrower annually to complete an occupancy certification

HUD AMI Chart:

LAHTF Funding Orientation #1 Zoom Recording

Date: Sep 20, 2023 09:38 AM Eastern Time (US and Canada)

This video is a recorded presentation of the

The Louisville Affordable Housing Trust Fund including

an overview of the project and an orientation

about the application guidelines and process.

To view, click on the button below and use Passcode: 4!uFY&?&